By Elyssa Lopez

Philippine Center for Investigative Journalism

First of two parts

The piecemeal and problematic implementation of the Renewable Energy Law is blocking clean and cheap energy for millions of Filipinos.

When industrial engineer Paul Baes returned from an official work assignment in France in 2020, he was determined to turn his first home in Imus, Cavite into a sustainable one. After spending two years in the four-season country, Baes saw the benefits of owning a solar-powered home in tropical Philippines. It simply made sense.

“Most of my colleagues there (in France) were excited for the summer – not just for sand and seas – but because of the potential electricity savings,” he said. Most of Baes’s French co-workers have solar panels installed in their homes even though they only enjoy the most sunlight during the summer months.

Baes’s dream of a solar-powered home has since become reality. For over a year now, his electric bill has been zero.

“Aside from the economic savings, I think it’s also time to contribute something positive to the environment. We don’t want our child to suffer due to past and current neglect and carelessness,” said Baes, whose wife recently gave birth to their first child.

But Baes’s home is one in a million. As of October 2022, only 7,365 of the total 26.4 million households in the country have benefited from the government’s “net metering” program, more than a decade since it was introduced through the Renewable Energy (RE) Act.

Net metering customers can power their homes through solar panels, and when these panels produce more electricity than needed, they may sell the excess power to distribution utilities.

The slow take-up of net metering is only one of the many effects of the dismal, piecemeal, and problematic implementation of the landmark law, preventing many Filipinos from having homes like Baes’s.

When the Renewable Energy Act, or Republic Act (RA) 9513, was passed in December 2008, the country was reeling from the effects of the global financial crisis. It was envisioned to drive investments in the country’s expanding renewable energy industry. In fact, by the time the law’s implementing rules and regulations were published in 2009, a third of the country’s energy already came from renewable energy sources.

These sources are available in abundance and are replenished by nature such as the sun, wind, and water, and emit little to no greenhouse gases or pollutants into the air. The passage of the law was meant to ride on this momentum, help spur the development of affordable and cleaner energy sources, and lessen the country’s high dependency on fossil fuels.

But 14 years since the law was passed, high electricity prices prevail, no thanks to the high cost of imported fuel running most of the country’s coal-fired power plants. From 30% in 2009, renewable energy sources now account for just 21% of the country’s power mix. Coal continues to have the biggest share.

Stakeholders blame the “dilly-dallying” of the past administrations on the law’s piecemeal implementation as well as the problematic execution of some of its mechanisms. Environmental groups even had to file a case before the Supreme Court to push the Department of Energy (DOE) to implement the other mechanisms of the Renewable Energy Law.

RE law on the slow lane

“The impact of the full implementation of the Renewable Energy Law mechanisms is just starting… kasi talagang nag-dilly-dally sila (they dilly-dallied) in the last decade,” said Gerry Arances, executive director of Center for Energy, Ecology and Development (CEED).

CEED is part of the Philippine Movement for Climate Justice (PMCJ), a network of environmental groups and individuals that filed a petition for mandamus before the Supreme Court in 2017 to compel the DOE and the Department of Environment and Natural Resources (DENR) to implement their mandate as “vanguards of energy security and environmental sustainability.”

The petitioners accused the two departments of allowing “coal plants to proliferate, making the country more, instead of less, dependent on fossil fuels.”

One of PMCJ’s petitions was for the DOE to implement mechanisms in RA 9513 to mainstream the adoption of renewable energy sources in the country such as the Renewable Portfolio Standards (RPS) and the Green Energy Option Program (GEOP). (Mechanism descriptions will also be included in the timeline infographic.)

The DOE did not contest the petition. By the end of that year, it released guidelines for the RPS, the mechanism forcing utility companies to tap renewable energy plants. But the GEOP guidelines, which allow commercial and industrial customers to source 100% of their energy from retail renewable electricity suppliers, were only promulgated in 2021.

Another mechanism, the Green Energy Auction Program (GEAP), which aims to supplement the RPS requirements of distribution companies by auctioning certain capacities to renewable power generators, was only implemented in 2022.

“The problem with the DOE is it has circulars, but can they implement it?” a solar energy farm operator told PCIJ. “Policy is not enough.”

RE law timeline chart:

Scheme to scale up RE opposed

Before the 2017 Supreme Court case unlocked multiple Renewable Energy Law mechanisms, the DOE had already started implementing the Feed-in-Tariff (FiT) scheme, a widely used tool for developing renewable power.

In a FiT scheme, renewable energy producers receive guaranteed payment on a long-term basis, usually spanning 15 to 20 years. The cost of the tariff payments is typically shared with consumers. In Vietnam, the FiT scheme built a solar capacity of 4,460 MW in just two years. Now at least a tenth of its generated electricity comes from solar power.

But when the mechanism was introduced in 2010, it was met with criticism over the price and duration set by the government.

The Energy Regulatory Commission (ERC) set the FiT price by the kind of RE technology and the duration at 20 years. At that time, the country’s rates were at a premium compared with generation rates offered by fossil fuel plants and were also higher than those offered in the rest of the region.

“At the early part of the implementation of the feed-in tariff, there was a lot of opposition,” former energy undersecretary Jay Layug told PCIJ. “In fact, one of them even filed a case… Foundation For Economic Freedom (FEF). They were complaining about renewables being expensive.”

FEF is an economic lobby group whose members include past and present Cabinet members. It is headed by former officials of the Marcos Sr. administration, namely Cesar Virata and Gerardo Sicat.

In 2011, FEF filed for a temporary restraining order against the hearings of the ERC, the agency in charge of setting the FiT rates, supposedly over its “questionable procedures.” The group argued that guaranteed payments to RE developers were subsidized by consumers and were reflected on their monthly electricity bills.

“It really does leave a bad taste since you see it as an additional charge in your bill,” Albert Dalusung III, adviser for the local think tank Institute for Climate and Sustainable Cities (ICSC) told PCIJ. “But without it, we would have paid higher electricity prices.”

Aside from guaranteed payments, eligible RE developers under the FiT scheme were also assured of connection to and transmission from the grid. This is called the “priority dispatch policy.” As price takers in the wholesale electricity spot market or WESM, RE plants can then displace the more expensive energy resources like coal-fired power plants.

Perceived high cost of RE

The scheme did attract investments. The years 2014 and 2016 saw the highest year-on-year increases in renewable energy installed capacities in the past decade, as the applications on the two rounds of FiT were swarmed with interest from both local and international investors.

The later round also adopted a “first-to-build” policy, meaning developers must have completed 80% of the project before a stated deadline for them to be eligible for FiT benefits. In a race to acquire these incentives, developers rushed to build plants.

“But we never got to fully transmit our capacity until 2021,” said a representative of an RE company that was awarded FiT benefits in 2016. “For years, we only sold 50 percent of our capacity.”

The source requested anonymity over concerns their future participation in RE programs could be affected.

This was common among renewable energy developers, which had renewable power produced but could not sell it because the electricity grid isn’t fully developed in areas where they are located.

Read Part 2 of this report: “Developers are ready to build more solar farms — they just can’t connect them to the grid.”

Critics said FiT proved incapable of developing the renewable energy industry.

“The added capacity of FiT-eligible generating plants did not translate to a growing share of RE in the power generation mix with coal contributing 50% of the total mix,” a 2020 Ateneo paper on the economic effects of the FiT policy read.

“With the continuing increase in electricity prices, the FiT is turning out to be an additional short-term burden to the Filipinos.”

Dalusung said the FiT program managed to increase the country’s installed renewable energy capacity.

“But it was not enough. It was not enough to stem the huge uptake on coal-fired power plant generation,” he said.

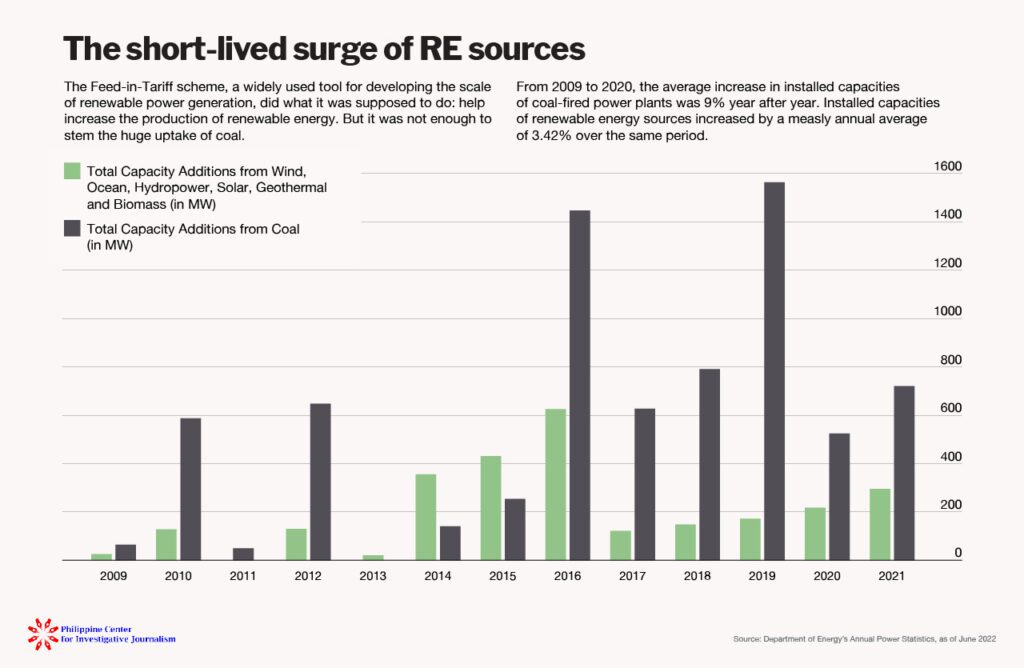

PCIJ’s analysis of DOE data showed that from 2009 to 2021, the average annual increase in installed capacity of coal-fired power plants was 9%. From 4,277 MW in 2009 when the RE law was passed, it nearly tripled to 11,669 MW in 2021.

Renewable energy capacity meanwhile increased by just 3.42% over the same period, from 5,309 MW in 2009 to 7,914 MW in 2021.

RE sources chart:

The “perceived” premium cost of renewable energy technologies over other power generators also slowed down the implementation of the law, said Mylene Capongcol, director of the Renewable Energy Management Bureau (REMB).

For context, data from the International Renewable Energy Agency (IRENA) show that in 2010, the average global cost of electricity from solar projects was $0.417/kwh or P23. By 2021, it had dropped by 88% to $0.048/kwh or P2.66.

“The concern before of distribution utilities was RE was expensive,” she said. “Without government subsidies, it would be consumers who would be shouldering the cost [of the technology].”

‘Non-existent’ RE policy under Cusi

It did not help that the former DOE secretary had expressed aversion toward the scheme meant to scale up green energy sources.

“In any race, there’s a winner and there’s a loser… If you (renewable energy developer) don’t qualify (for the second round of FiT) then you should know your options, which are either the spot market or bilateral contract,” former Energy Secretary Alfonso Cusi said in a 2016 interview with BusinessMirror.

For industry players, this stance turned off foreign investors and in effect limited their financing capacities.

“What was important (for developers) was the presence of a regulatory framework,” CleanTech CEO Salvador “Aboy” Castro said. “But for the past six years (of the Duterte administration), there was no incentive for us, no way for us to secure long-term offtake agreements.”

CleanTech secured the second round of FiT benefits for its first solar farm project in Bulacan, which was established in March 2016. Castro said the company had to partner with a foreign private equity firm to finance the project. When the farm was launched, Castro began talks for further expansion, in the hopes of joining another round of FiT incentives. But the non-launch of the incentives dashed expansion plans.

“Banks weren’t open to merchant solar farm projects. They want projects that had predictable cash flows and FiT provided that,” he said.

The lack of a regulatory framework was also seen as one of the reasons banks were reluctant to extend loans to renewable energy developers. Some stakeholders observed that the banks preferred to lend to fossil fuel projects due to a lack of expertise and understanding of the renewable energy industry.

Green energy auction prices too good to be true?

In 2022, the DOE started implementing the GEAP, which allows renewable energy developers to bid for a specified energy generation capacity. This auction was meant to help distribution utilities comply with the Renewable Portfolio Standard (RPS) requirement to obtain at least 1% of their power from renewable sources.

Industry players had high hopes for the program. In August 2022, the DOE increased the RPS requirement to 2.52%. For the first round, it allocated 2,000 MW, distributed to solar, wind, hydro, and biomass. Like FiT, the auction winners were guaranteed profits under a fixed price.

“We were excited about it,” said a representative of a renewable energy company who participated in the auction. “But the DOE bastardized that auction.”

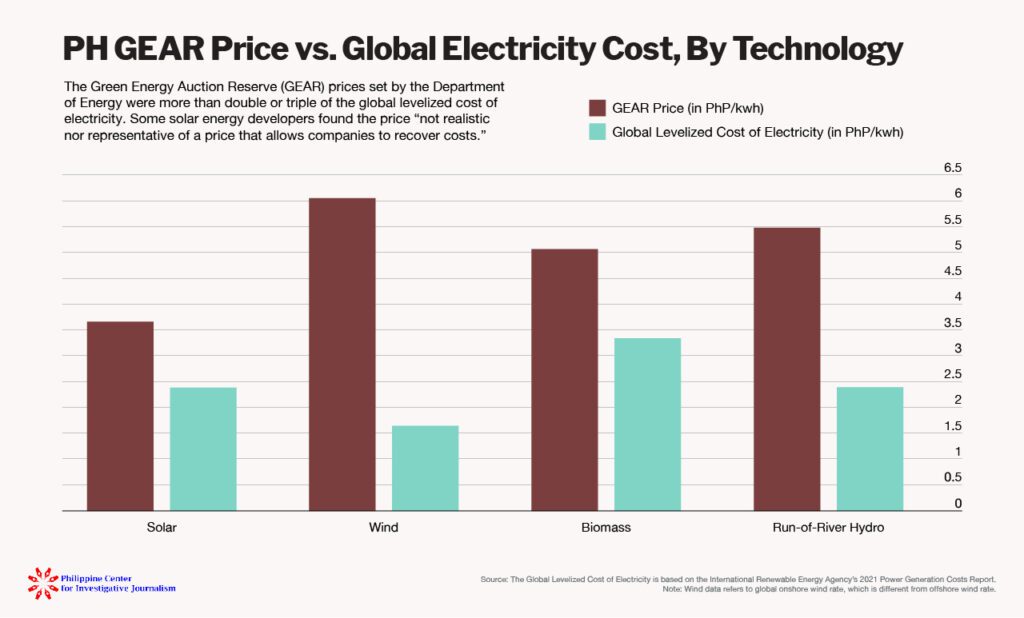

For the developer, who has three solar farms, the green energy auction reserve (GEAR) price set for solar energy developers was “not realistic nor representative of a price that allows companies to recover costs.”

The GEAR prices set by DOE were more than double or triple the global levelized cost of electricity. (See Chart 3)

The ERC, then headed by Agnes Devanadera, said in a statement that the GEAR prices were set “using the Discounted Cash Flow Model with 46 parameters and assumptions for each technology.”

One of the assumptions in setting the GEAR prices, for example, was that the U.S. dollar to peso exchange rate was P53.145, the average forecasted exchange rate for the fourth quarters of 2022 and 2023. By the end of October 2022, the exchange rate had jumped to P58.28.

“Based on the latest exchange rates, I doubt those that won the project can manage to build the plants,” the solar operator said.

The ERC also said the prices were within the range of the rates reflected in power supply agreements or PSAs with renewable plants. GEAR prices are not subject to escalation or adjustment, therefore, the prices are fixed during the entire lifespan of the project. Rates in PSAs, however, are subject to price adjustments.

The case of Leviste’s Solar Philippines

For example, Solar Philippines, which cornered 91% of the GEAP auction capacity made available for solar projects, has had a history of applying for rate adjustments. Solar Philippines is owned by Leandro Leviste, son of Sen. Loren Legarda.

Leviste had been partnering with conglomerates to fund his projects. In 2020, Solar Philippines signed a joint venture with Enrique Razon-led Prime Metroline Infrastructure Holdings Corp. to build a solar farm in Tarlac. In 2021, a subsidiary of Solar Philippines went public. The company initially started as a rooftop solar builder in 2013, but it has since pivoted to developing solar farms.

The company made headlines in 2017 when it signed a PSA with the country’s largest distribution utility, Meralco, at a rate of P2.999/kwh. At that time, it was the lowest rate offered by a solar developer in Southeast Asia.

In 2019, however, the company secured approval from ERC to raise the agreed rate by 2% annually. Some groups contested this move. By the end of the 20-year period, the rate would be P4.457/kwh, still much lower than the rate offered in the second round of FiT.

PCIJ reached out to Solar Philippines for comments in January 2023. We have not received a response as of publication.

For the solar farm operator, such moves limit companies like his, which had previously relied on FiT incentives to expand.

Castro of CleanTech echoed the sentiment, saying the competitive selection processes of distribution utilities were usually “restrictive” for independent renewable energy developers, especially with the “competitive rates” demanded by the procedure.

“We all have our own investment thresholds… and we are looking for something more palatable,” he said.

Broader participation of more companies in the auction would have also inspired more confidence that the auctioned capacities would be delivered on time, especially with the imminent energy supply crunch, Dalusung added.

“Here, you’re depending on one corporate entity to deliver 1,350 MW. Just one. I’ll be more comfortable if there were like 10 of those companies building the plants,” he said. “The delivery time of the projects is also by 2025… if we had quote-unquote expensive solar coming in quicker, it may have addressed our near-term power requirements.”

While the GEAP managed to secure lower power rates for consumers, consumers must remain vigilant, said Marlon Apanada, Southeast Asia engagement lead for energy and climate at World Resources Institute.

“What needs to be done is to be vigilant again, that those auctioned capacities are actually built,” he said. “Because there were instances (in other countries) when developers bid so low that they weren’t able to build.”

In an interview with PCIJ in December 2022, Capongcol of REMB said the DOE had already forfeited the 100MW awarded to one company during the auction because the firm failed to submit the required performance bond on time. The company will also be barred from offering the same facility in future auctions.

“The company asked for an extension, but we decided not to grant them,” she said.

Capongcol admitted that the current macroeconomic situation caused by the continuous lockdowns in China, the source of major hardware components of RE technologies, might affect the financing options of winning bidders in the GEAP.

“We’ll see how it goes… But we have a performance bond and we are ready to call them out,” she said.

In Brazil, for example, of the 17 auctions conducted for wind projects since 2009, only 10 had met the implementation deadline, according to a 2019 study by the International Renewable Energy Agency. More than a tenth of the projects were ultimately canceled.

Aside from supply constraints, wind power projects in the country were mostly delayed due to transmission problems of the plants, the organization said.

“Grid connection was stated as the principal reason for the delays in early rounds, with little coordination between the expansion of renewable energy and that of transmission grids,” IRENA said in the report.

The story is the same for the country’s renewable energy developers.

“In the Philippines, it takes two to three years to build a solar plant, and that [delay] is just because of NGCP (National Grid Corporation of the Philippines),” a solar developer said. “If you solve that, we can build a plant in six to 12 months, depending on the size.” –With research by Martha Teodoro, PCIJ, March 2023

Next: Developers are ready to build solar farms — they just can’t connect them to the grid

0 Comments